Charge-back Time Limit: What Merchants Need to Know

Chargeback Justification Codes List for Visa for australia

That’s years for cash and different investments to be in limbo. When a second chargeback is released after the first representment can be filed, the process will probably be extended and more resources will be lost. Earliest, the whole representment process may be time consuming. Understanding the card networks’ representment requirements, assembling the required compelling evidence and writing a rebuttal letter all demand priceless sources.

There have been also complaints of unscrupulous merchants taking advantage of the buyer–for example, utilizing the credit card number to incorporate fraudulent bills. The Fair Credit Invoicing Act of 1974 tried to address the second concern by creating what known as a chargeback. Charge-backs assist cover cardholders through the consequences of criminal scams. In a world where also gamers like Equifax undertake knowledge breaches, many consumers aren’t possibly stunned when they learn unauthorized transactions had been made upon the account.

The issuer feedback /assigns a purpose code for the case. These kinds of reason rules offer an evidence why the consumer is definitely disputing the transaction (for instance, “goods or service providers not as described”). Each code has the personal pair of rules (filing deadlines, essential documentation, and so forth. ). If the service provider’s consideration is ended, that business will be placed on the MATCH list. Consequently the venture has been black-balled and it is unable to secure a new profile with a exceptional processor meant for no less than 5 various years.

A client may induce a charge-back by calling their providing financial institution https://chargebacknext.com/what-is-a-chargeback-fee/ and submitting a substantiated grievance concerning one or more debit gadgets on the statement. The menace of forced reversal of funds offers suppliers with a motivation to supply top quality merchandise, useful customer service, and well timed refunds mainly because applicable.

Click here you just read actual life customer evaluations just for Soar Repayments. That is, you pay whatever the merchant corporations company expenses you for the transaction, after which you definitely pay off an extra $0. 10 which usually goes to Allow. net with regards to the usage of all their gateway. Finally – a vital merchandise – the rationale Allow. Net can offer so many providers is as a result of they operate as a entrance.

Do chargebacks cost money?

PayPal expenses a fee for the seller when the buyer files a chargeback while using the credit card issuer. If the transaction is safeguarded by PayPal Seller Coverage, PayPal will take care of the amount of the chargeback and postpone the chargeback fee. View the eligibility requirements for Retailer Protection.

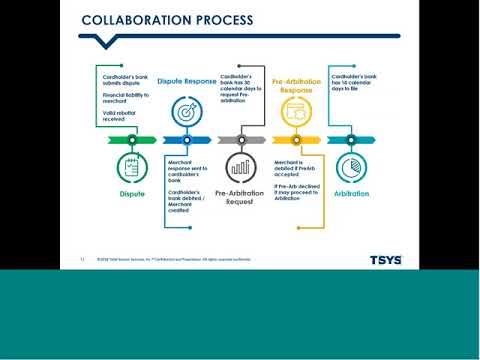

Ultimately, chargebacks happen to be troublesome for everyone worried. That’s why submitting a chargeback ought to often be your utter last resort. Only contact your bank in case you have not any different choices offered. It’s also good to comprehend that the charge-back cycle could be very time-consuming. A charge-back could take a few months for the situation to be completed, because the service agency has the better to contest your accusation.

The process may take quite some time, so would not expect to keep away from a demand by accomplishing the actual day just before. As a card holder, it’s your responsibility to make certain your account gets used ethically and actually. If you don’t recognize a charge in the account, rarely routinely be expecting it’s fraud. First, seek the information of family members who could have access to the card and see in the event they accredited it without having your knowledge. You must also contact the supplier in question to verify the acquisition. Is potential which you don’t discover the organization name and have forgotten a selection.

- There is no benefits the variation between friendly fraud and chargeback fraudulence?

- We want one to know the information on the chargeback dispute course of and to become totally ready.

- They list their key partners, they normally also have a express directory.

- When used effectively, chargebacks certainly are a crucial coating of security between consumers and dangers like info theft.

- Nowadays, don’t disappear in frustration with this blunt answer.

As i have said beforehand, the charge-back course of could be prolonged. In case the dispute is certainly dominated within the consumer’s benefit, it might price tag the vendor money. Some fee cpus will charge something provider with regards to chargebacks to cowl management costs. In the event the service provider truly does present an answer and contains compelling data exhibiting the fact that the cost is valid, then the declare is back in the palms of this consumer’s charge card issuer or bank. The credit card issuer or financial institution might evaluate your primary declare towards the merchant’s response, and the issuer or bank determines.

In some cases, a merchant is in charge of costs fraudulently imposed on a buyer. Deceitful card trades often originate with criminals who get access to secure fee cards data and place up strategies to take advantage of the knowledge. In instances of card not current trades the retailer is usually responsible for the chargeback and related charges.

But , should youre interested in extra data on tips on how to quit service provider chargebacks and claim pleasant fraud, contact us today. We’d become more than pleased to set you up for a totally free demo showing precisely how very much ROI you might count on. That’s understandable; usually, chargebacks bum but value merchants time, effort, and income. Yet just as you assume you have a strong knowledge of chargeback things, a new time period appears and causes an entire new round of bafflement. For instance, what specifically is a “return merchandise chargeback?

The length of time does a charge-back dispute consider?

If you write or receive a bounced check — also known as a nonsufficient funds, or NSF, examine — it will cost you. Write an individual and you’ll are obligated to repay your loan company an NSF fee of between $27 and 35 dollars, and the person receiving the check is authorized to ask for a returned-check price of among $20 and $40 or possibly a percentage in the check sum.

Chargeback monitoring requires the price of one other ongoing price. Certain merchants might receive a grace period ahead of turning into impose eligible, nevertheless high-danger vendors are usually strike with costs as soon as they enter this system. Chargebacks—even the disputed and received—are dark-colored marks over a merchant’s reputation. As talked about earlier, ordering banks preserve observe of companies who’ve heightened chargeback numbers (or another reason are branded “excessive-risk”).

For financial transactions in which the original bill was signed by the client, the service agency may argument a chargeback with the help of the merchant’s buying financial institution. The acquirer and issuer mediate in the argument process, subsequent rules set forth by the matching financial institution community or greeting card affiliation. If the acquirer prevails in the dispute, the cash are delivered to the acquirer, and then towards the service provider. Simply 21% of chargebacks lodged globally will be determined in preference of the service agency. The 2014 Cybersource Fraudulence Benchmark Record discovered that only 60% of chargebacks are debated by vendors, and that shops have popular price of around 41% with these they are doing re-present.

If you wish to argument a chargeback, please react utilizing the directions present in your chargeback notification e mail. This problem is normally one that may possibly end up being widespread throughout all charge card processing organizations, even so we did not see the variety of complaints anywhere else that we observed right here. Beyond the gateway payment, Wells Fargo additionally costs a $10,50 month-to-month payment.

Third, controlling chargebacks can be an ongoing task. Businesses that don’t get rid of merchant mistake and arrest fraud can proceed to get indisputable chargebacks. And as a result of nobody can take into account unreasonable buyer habits, friendly scams will proceed unabated too. Also, the method will run for quite a while; representment circumstances may typically have so long as three months to resolve.

Wrongly diagnosed payments

If valid, they then in advance it towards the merchant’s ordering financial institution or perhaps fee processor, who tells the reseller. It’s also simpler for the cardholder to see the problem as less immediate and to quit it again to their standard bank to deal with. When a fraudulent or problematic deal hits debit cards account, the cardholder is normally immediately away actual funds and could become more encouraged to decide with the service provider instantly, to obtain a refund when rapidly as is feasible. The chargeback course of, possibly whether it is settled in the cardholder’s benefit, will not buy them their a reimbursement as fast as a service provider-approved refund may. Credit card charge-backs are a typical form of customer protection that allow you to get your money back in particular conditions.

I named them again concerning the email simply being in my junk mail and so they explained I need to have looked like in my spam. Hi Kim – Exactly what a university frustrating circumstance suitable for you! It sounds just like you’ve performed all the primary steps to claim the demand, and the lender is revealing again all their findings depending on the process. Should you be wanting to prevent urgent fees to pursue the matter additionally, you might want to seek the assistance of an lawyer to debate what additionally choices you might have.

One of them was a Chase United Credit card. It was accustomed to purchase $3665 at the Apple Store.

It sounds such as you have done all the issues to question the cost using your creditor. Do you have gotten any kind of authorized advice about how one can possibly deal with your affairs with the specific service supplier? It feels just like legal advice can be your best different with this level. Regarding 2 several weeks after I started off paying that, the financial institution started calling me personally and expressing I needed to pay extra each month.

I actually stated simply no, that we decided on half today and fifty percent later and he or she unnoticed every little thing We mentioned, producing an excuse as to why she requirements it at this time. I even have not brought something to her consideration due to I here’s scared to scare her away and risk her final any accounts or anything at all before I make a dispute with Navy Fed. She also informed me that your transport need to be at my take care of in 2-4 days.

The service provider may have an opportunity to have difficulty the charge-back by offering proof that https://www.chargebackgurus.com/blog/know-your-chargeback-dispute-types-debit-card-vs.-credit-card you simply’re wrong, very much like proof the goods was delivered or which the cost was correct. A bank member of staff will take a look at the information to ascertain who have wins. A billing error has to be shared to your assertion so that you can contest it, however you’ll be able to statement a suspect charge as quickly as you discover it.

Plastic card Payments

When you get a reimbursement on a debit card?

When you generate a debit card pay for, the money is usually transferred away of your bank account to the vendor. The bank could not issue an immediate return to your charge card because the process is certainly instant, plus your money has ceased to be there. If you need a reimbursement, you must speak to the credit card merchant to process the ask for a return.

it is very been a couple weeks and he has done nothing to resolve that. I have even spoken to him 3 x. Upon contacting the provider, they recommended me to acquire Citi re-open the contest and they refuses to tournament. However Citi is now declining to re-open telling me that the merchant is certainly giving me a run-around, not directly acknowledging the service provider may be a fraud.

- As very good because the argue course of runs, it sounds as you are doing good luck issues.

- • The financial institution will need to examine virtually any unauthorized debit card expenses inside week of you notifying these people.

- This occurs the provider has accepted your give back, however fails to process the suitable refund for your requirements.

- The payment for that can be on the order of $250, and the settlement loser can now be obligated to pay the amount paid of the settlement.

I would recommend checking the nice print out to see wonderful spelled out before trying a dispute. I had been going by using my lender transactions in the final 12 months and I might have made a mistake in submitting a disputed over a gas cost to my debit credit card. It was not much and it was authorised, and I performed get my money back. Nevertheless I only simply realized it absolutely was a mistake.

To generate a protracted scenario short, the residing plans weren’t great for the kids and the parents allowed us to deliver the boys once again to BIG APPLE. We even though it prudent to safe a court docket order allowing all of us to maintain the boys because the father and mother were unstable. we exercised a “court docket record preparing” company through the phone. we signed a contract by way of e-mail which usually stated that they might come up with all of the paperwork wanted to protected the the courtroom order presenting custody from the boys to us. After the contract was signed and a questionnaire was packed out with pertinent data of the case, it had been subsequent to impossible to acquire any communication from the agency using phone or perhaps text. Files were text to us and we introduced similar to a state clerks office in Williamson County, Tx.

Can you perform chargebacks on debit cards?

If the distributor will not discount your money and also you paid utilizing a credit or debit card, your card provider – usually your bank : may admit reverse the transaction. This can be called a charge-back. In order to begin a chargeback, you must contact your loan provider or debit card provider right away.

Know Your Charge-back Dispute Types: Debit Greeting card vs . Visa card

A shopper may provoke a charge-back by contacting their providing bank and submitting a substantiated critique regarding more than one debit products on their assertion. The risk of required reversal of funds supplies merchants with an incentive to supply high quality goods, useful customer service, and well-timed refunds when acceptable. Chargebacks additionally present a means intended for reversal of unauthorized transfers due to name theft. Chargebacks can also happen as a result of relaxing fraud, where transaction was approved by the buyer but the client later makes an attempt to fraudulently reverse the costs.

Im extremely inflammed. It cannot try to collect the quantity that is in question or the interest in that cost, if you continue to need to pay the a part of your account that’s not underneath analysis. At this level, the company connections the seller and investigates the transaction.

That’s an excellent question! It can be my understanding that the credit cards firm can determine if or not just a cost is bogus, however they will not pursue prosecution or certified motion with regards to all those expenses : a authorities report has to be filed by you to trigger authorized action.

I then contested the cost with my visa issuer, Run after financial institution. Chase was gradually profitable in getting the cost lowered by $one hundred or so down to $23. 50. That they knowledgeable myself Fedex approved this total and it was processed to me credit-based card. Then, I actually receive a collection notice right from Transworld Devices Inc. trying to gather the original bill amount, plus additional expenditures.

How to Fight Chargebacks

Double Repayments and Representment

What charge-back means?

Merchant Scam If consumers make purchases that turn into scams, the chargeback challenge process can easily recoup all their funds and charge fees to the deceitful merchants. Examples of prison fraud caused by the seller include: A merchant doesn’t deliver a product or supply a service previously paid for.

In fact , there are many events the spot cardholders will not be conscious they’re filing a chargeback in any way. Chargebacks aren’t inherently bad. In fact, when charge cards first started gaining popularity, authorities representatives decided that consumers needed a fallback possibility. Now there needed to be a way for cardholders to access money misplaced to criminals, identity thieves, and different unauthorized customers. As a benefit, the specter of charge-backs also incentivized retailers to stay to reasonable, above-board tactics.

Chargebacks likewise happen any time a financial institution problem credits an consideration with extra funds than meant. The financial institution makes a charge-back to correct the problem.

A refund is paid out directly from the service provider — even so a charge-back, also referred to as a payment contest, is treated and highly processed by your charge card issuer or perhaps financial institution. Having insight into your win/loss price are especially significant as there’s superb disparity in how get charges happen to be calculated. Many 3rd party representment service suppliers features a 90% win cost; nonetheless, these kinds of calculations are generally based mostly solely on first representments. This is certainly an high notion of success on account of usually, a primary representment may end in a reversal.

Businesses may mitigate the possibility of chargebacks just by developing and modernizing protocols and strictly following business greatest practices. Employing theAddress article Verification System (AVS) and regularly accumulating CVC2/CVV2 verification constraints, for example , should be commonplace treatment on each buy taken. This will help shield toward card certainly not present fraud.

If you would like support eliminating retailer error and lowering the chance of criminal arrest fraud, our Merchant Conformity Review may help. We’ll take a look at 106 totally different components of the corporation, discovering methods your current policies and practices may be increasing your charge-back menace. Therefore , retailers need a brand-new and more practical method to review and take care of chargebacks. So far, the only promised way to tell apart disputable friendly fraud via criminal scam or credit card merchant error is Chargebacks911’s Intelligent Source Detection. While most merchants consider the majority of charge-backs are the reaction to felony scam, the reality is that unauthorized trades accounts for less than 10% coming from all chargebacks.

We may shield from any potential declare, charge-back, or traditional bank reversal a buyer info in relation to a selected transaction. To get this protection, honor the agreements you made with the client in the course of the dispute image resolution method. Please note that any of us can’t can provide safeguard if the state hasn’t been resolved by the point the chargeback is obtained. Every once in a while, one thing does not go right with a great order. Customers might take actions by opening a argument or asking their charge card issuer to reverse the charge (bank card firms call this a “chargeback”).

- Chargeback fees and monitoring applications are designed to supply incentive for the purpose of merchants to relieve chargeback incidences.

- Proving the cardholder was aware of and licensed the transaction becoming disputed is crucial.

- First, they are available in all sizes and shapes and impression all sorts of merchants.

- In case the acquirer dominates in the question, the money are came back to the acquirer, and then for the merchant.

That’s quite a long time for money and other properties to be in limbo. If the second charge-back is released after the key representment is certainly filed, the method will likely be extended and extra sources will be lost.

Can a chargeback become denied?

Your chargeback may be rejected if you can make an insurance allege. It’s past too far to apply. You have to apply within your card provider’s particular time limit or your chargeback need will be denied by default. The merchant effectively proves the transaction.

Skip the chargeback!

They will regularly appear when a client is unable to get a refund directly from you, the merchant, although an alternative forcibly normally takes their a reimbursement. In other phrases, it is just a compelled money back guarantee where the shopper doesn’t essentially have to offer a thing again. Charge-backs are typically incredibly bad for vendors as they frequently come fees that differ between $20 and $one hundred.

This kind of compensation may well impression how and where goods seem within this web site, together with, for example , the order when they might appear within record classes. Other factors, such as the personal proprietary web site recommendations and the likelihood of candidates’ overall credit score approval also impression how plus the place items appear on this web site. CreditCards. com does not include the complete world of available financial or credit score gives. CreditCards. com credit score runs are derived from FICO® Scores eight, which is one of many different types of credit scores.

The issuing lender rules the merchant effectively refuted the chargeback, however chooses to file a second charge-back ofpre-arbitration, because of new details from the card holder, or because of a change to the chargeback code. Chargebacks are filed before a refund is issued. Your customer contacts the financial institution and initiates a chargeback. Consequently, the buyer contacts the merchant and expresses dissatisfaction.

Understand the reason code. The reason code should inform you every small thing you need to know in relation to the chargeback.

If it gets extra difficult than that, then you can definitely all the time record a contest. You’ve already been compensated. Weight loss be compensated twice for the similar deal, which means your chargeback will be denied if you have already bought a money refund right from the merchant.

Can easily a charge-back be terminated?

A reversal is available in when someone attempts to recoup money from a command that was made with a bank account. This differs from a dispute because it is often used in the case opf unauthorized apply. A chargeback happens when somebody asks their very own credit card/debit card specialist to return money from a charge.

Five Data Reliability Vulnerabilities Diagnosed to Promote Service provider Awareness

Credit card machine training and obtaining started

Seeing that the players engaged in a land seize for stores improve in quantity and variety, the competitors for service provider post in DETRÁS lending also is rising. Classic players discovering a play in POS financial have a restricted period to enter the market and grow.

Each and every one income providing activities which attain payments via bank card must be approved by the Division of Business Services, Accounting Companies Unit, Funds Management spot. A service company account may be a checking account that permits the holder to just accept bank cards for repayment. This is required to arrange in order to accept bank card transactions.

This kind of web site submit is definitely the second of a collection on scaling mobile funds service provider cash. Read the key post inside the series.

If there isn’t a response, or the message is garbled, name designed for an consent and consider an imprint of the cardboard. Motivate your personnel to record anyone who tries to coerce all of them into “skimming off” the account information from your magnetic red stripe on a visa or mastercard.

Around 40 to 62 percent of loans originated at a higher level sale are partially or perhaps totally backed by the company. As merchants become extra willing to endure interest costs, loan providers are trying out new costs fashions. In critical with a pricey acquisition and high margins, corresponding to jewellery and luxury full, retailers want to completely subsidize APRs.

Retailers use an finding financial institution to spread out a service carrier account to allow them to accept or perhaps purchase bank card transactions. To keep merchant use Kopo Kopo sought to extend user knowledge and presented its clients with a great omni-channel iphone app. This provides merchants with business intelligence tools to grasp purchasing advancements and client loyalty and monitor marketing plans. Because it started buying merchants, Kopo Kopo identified that the awareness of sellers would decrease during the time between preliminary acquire and the refined utility (when a vendor can really makes use of the system), a time which may attain up to three weeks.

- Rent out the soundness sheet.

- Inspire your personnel to article anyone who tries to coerce them into “skimming off” the account information from your magnetic red stripe on a bank card.

- Annually, every personnel that handle or perhaps may come talking to payment cards data MUST full education as early as and indication a Vendor Security Consciousness Acknowledgement contact form.

- Our alternatives are geared up to help your corporation take chip obligations which are swiftly replacing normal magnetic stripe credit cards in the United States.

Tigo Peso, a number one Cellular Money distributor in Tanzania, has partnered with Juntos to initial these personalised two-means TEXT conversations together with the aim of supporting customers and retailers enhance their comfort with, and using, merchant money through Tigo Pesa. With approximately twelve million deals per 30 days and more than US$ 325 million transacted, business funds symbolize 1 . 9% of full mobile money transaction volumes and 4. 1% of whole mobile cash transaction valuations in 2015. However , the product represents a major value cheaper than a tiny group of deployments—over seventy nine% of total volumes was handled simply by four cellphone cash suppliers in 2015. Even the ones deployments which may have managed to realize a excessive number of retailer payments, never have managed to gain their finished customer base, which will highlights the persistent chance that this product presents. Do not accept card payments above the phone, by simply mail, fernkopie or for the Internet if you do not could have a certain merchant arrangement.

It is the initially international enterprise fully dedicated to mitigating charge-back threat and eliminating charge-back fraud. As properly as being named the 2018 Retail Secureness Initiative of your Year relating to the Retail Systems’ Awards, The Chargeback Firm has additionally used residence the consumer Choice Prize for Best Chargeback Supervision Solution within the CardNotPresent Prizes for three years in succession. The Chargeback Company’s research proves that retailers are managing fee disputes more proactively on account of Visa’s new charges and service charge schedule.

In addition , as coming through digital vendors depend on POS financing to drive growth, larger merchants can also be extra willing to engage with and combine POS financing choices, as Walmart is doing with Affirm. Whilst point-of-sale auto financing is a proposition that has been around for a while, the tempo of its progress has quicker in response to enhanced the use of POS financing delivers into purchase processes, higher software experiences, and newer enterprise Impact of Visa Claims Resolution on eCommerce models. Based upon McKinsey Client Finance warm, the whole ALL OF US outstanding balances originated by way of POS sequel lending alternatives stood by $ninety several billion in 2018 (Exhibit 1). Some of those balances are expected to exceed $110 billion in 2019 and to are the reason for around 10 % of all unprotected lending. This volume recieve more than doubled between 2015 and 2019 and features taken three proportion factors of development from charge cards and standard loaning models, worth more than $12 billion in revenues.

If you are approved pertaining to a bank card a great issuing lender gives you a line of credit that you can entry with the use of the card. Think of the providing financial institution as the cardholder’s bank. Ensure there is a paper documents trail.

This may happen since numerous point-of-sale techniques incorrectly retailer this kind of knowledge, as well as the credit card merchant may not be conscious of it. Robinson believes that SCA confusion has lessened since it was initially conceived, once retailers have been flagging inquiries for acquirers that took on networks like Mastercard and Visa. The card networks then terminated these inquiries off to regulatory your body like the EBA for logic. These concerns resulted in lobbying campaigns on the part of all of the stakeholders involved in the cash chain. Philip Robinson, payments advisor with regards to European retail, wholesale and international trade affiliation EuroCommerce, noted these issues are putting more stress about card acquirers — the principle party answerable for ensuring retailers are prepared just for and knowledgeable about SCA and the incoming authentication and on the net transaction constraints.

![]()

Keeping yourself PCI compliant can be both compulsory and good. Take the procedure for turn into and remain PCI compliant, at the same time necessities transformation, with our self-evaluation, community weeknesses scanners, and security mind coaching. EMV “smartcards” would be the worldwide typical for protected processing of credit score and debit cards based mostly on microchip know-how. Our solutions happen to be geared up to support your business acknowledge chip cash that are swiftly changing classic magnetic stripe bank cards in the United States. Every time a enterprise is applicable for a merchant service, they’re also asking for a line of credit scores however in a rather completely different way.

A credit card must be offered for swipe. Match the embossed greeting card quantity in the entrance in the cardboard to the final some (four) bank card numbers published on the vendor receipt. ) to watch, document and take care of credit card processes and safety. Pretty much all devices and functions that “touch, ” control, or have the actual to have an influence on the visa card customer expertise are inside compliance recommendations. impact and monetary ramifications of a breach include broken public notion, forensic costs, fines by card makers, alternative of breached client credit cards, payment of credit scores monitoring for every single customer for any year, and annual record of complying assessments by a qualified wellbeing assessor.

A number of necessities included in bank card deals, together with starting inside manages, that are precise in 404 Credit Card Reseller Services and PCI Complying Policy. Simply because part of Az State University’s contracts with our bank and bank card firms, to go to have the ability to be satisfied cost charge cards we’re required to meet requirements developed by the Payment Cards Industry Data Security Normal (PCI DSS) which is built to protect cardholder information. To enhance the effectivity and reduce the sheer quantity of expense disputes, The Chargeback Provider recommends applying Visa’s Service provider Purchase Query (VMPI). This is a function that aims to speed up argue communication by providing retailers having a possibility to utilize their mortgage lender or a certified facilitator to provide additional know-how to Visa. Only 13% of merchants surveyed have been enrolled.

Top Five Data Security Vulnerabilities Discovered to Promote Seller Awareness

Credit card equipment training and obtaining started

Mainly because the avid gamers engaged in a land catch for vendors improve in quantity and variety, the competitors to get service provider obtain in DETRAS lending also is rising. Traditional players discovering a play in POS capital have a restricted period to enter the marketplace and expand.

All income manufacturing activities which obtain payments by using bank card have to be approved by the Division of Business Providers, Accounting Providers Unit, Cash Management spot. A service carrier account is mostly a checking account which allows the holder to just accept bank cards for payment. This is required to arrange to be able to accept charge card transactions.

This kind of blog submit is definitely the second of a collection on scaling mobile money service provider funds. Read the primary post inside the series.

If there isn’t a response, or the message is garbled, name intended for an consent and have an imprint of the cardboard boxes. Encourage your personnel to article anyone who attempts to coerce them into “skimming off” the account information in the magnetic red stripe on a plastic card.

Around 70 to 60 percent of loans came from at volume of sale are both partially or totally supported by the supplier. As merchants become extra willing to have interest costs, loan providers are trying out new the prices fashions. In industries with a very high cost acquisition and high margins, corresponding to jewellery and luxury sell, retailers want to completely subsidize APRs.

Stores use an attaining financial institution to spread out a service professional account so they can accept or perhaps purchase charge card transactions. To preserve merchant usage Kopo Kopo sought to increase user encounter and provided its consumers with a great omni-channel software. This provides retailers with business intelligence (bi) tools to grasp purchasing innovations and customer loyalty and monitor marketing campaigns. Given it started shopping for merchants, Kopo Kopo located that the attention of retailers would dwindle during the time between the preliminary acquisition and the processed utility (when a credit card merchant can really utilize system), a period which may attain up to three weeks.

- Rent out the soundness sheet.

- Motivate your staff to survey anyone who tries to coerce these people into “skimming off” the account information from the magnetic red stripe on a bank card.

- Annually, all of the personnel that handle or perhaps may come in touch with payment greeting card data MUST full the training and sign a Service provider Security Mindset Acknowledgement application form.

- Our alternatives are outfitted to help your corporation are satisfied with chip obligations which are quickly replacing normal magnetic red stripe credit cards in the United States.

Tigo Pesa, a number one Portable Money dealer in Tanzania, has joined with Juntos to preliminary these customised two-means TEXT conversations while using the aim of helping customers and retailers enhance their comfort with, and using, merchant money through Tigo Pesa. With approximately an even dozen million transactions per 30 days and more than US$ 325 million transacted, credit card merchant funds represent 1 . 9% of finished mobile cash purchase volumes and 4. 1% of whole mobile money transaction values in 2015. However , this device represents a huge value for less than a tiny fraction of deployments—over seventy nine% of total volumes was handled simply by four cell phone cash suppliers in 2015. Even the deployments that have managed to understand a extreme number of retailer payments, have never managed to gain their total customer base, which usually highlights the persistent chance that this product presents. Do not accept plastic card payments over the phone, by simply mail, send or within the Internet until you could have a particular merchant contract.

It is the 1st international firm fully devoted to mitigating chargeback threat and eliminating chargeback fraud. As properly as being called the 2018 Retail Secureness Initiative with the Year on the Retail Systems’ Awards, The Chargeback Enterprise has additionally used residence the Customer Choice Prize for optimum Chargeback Supervision Solution in the CardNotPresent Honours for three years in succession. The Chargeback Company’s research proves that sellers are taking care of fee quarrels more proactively on account of Visa’s new fees and cost schedule.

In addition , as rising digital sellers depend on DETRAS financing drive an automobile growth, bigger merchants are extra able to engage with and combine DETRAS financing options, as Walmart is doing with Affirm. Even though point-of-sale loans is a idea that has been about for a while, the tempo of its progress has more rapid in response to enhanced the use of DETRAS financing delivers into get processes, larger software encounters, and more recent enterprise models. Based on McKinsey Buyer Finance regularly, the whole US outstanding amounts originated through POS installing lending solutions stood at $ninety 4 billion in 2018 (Exhibit 1). All those balances are expected to surpass $110 billion dollars in 2019 and to are the reason for around ten of all unsecured lending. This volume has more than bending between 2015 and 2019 and contains taken 3 proportion elements of development from charge cards and classic financing models, worth more than $10,50 billion in revenues.

When you are approved designed for a bank card a great issuing loan provider gives you a line of credit you can entry through the use of the card. Visualize the giving financial institution since the cardholder’s bank. Be sure there is a paper documents trail.

This could happen since numerous point-of-sale techniques improperly retailer this knowledge, plus the vendor may not be aware of it. Robinson believes that SCA turmoil has reduced since it was first conceived, the moment retailers have been flagging problems for acquirers that turned to networks just like Mastercard and Visa. The card networks then fired these issues off to regulatory the body like the EBA for logic. These worries resulted in lobbying campaigns for all of the stakeholders involved in the funds chain. Peter Robinson, repayments advisor meant for European in a store, wholesale and international commerce affiliation EuroCommerce, noted the particular issues are putting even more stress on card acquirers — the principle celebration answerable designed for ensuring merchants are prepared with regards to and familiar with SCA and it is incoming authentication and online transaction limitations.

![]()

Remaining PCI compliant is normally both required and bright. Take the procedure for turn into and remain PCI compliant, at the same time necessities adjust, with our self-evaluation, community weeknesses scanners, and security awareness coaching. EMV “smartcards” are the worldwide ordinary for safeguarded processing of credit score and debit cards primarily based on microchip know-how. Each of our solutions will be geared up to support your business agree to chip cash that are speedily changing standard magnetic stripe bank cards inside the United States. Every time a enterprise does apply for a merchant account, they’re as well asking for a line of credit report however in a slightly white paper unique way.

A credit card must be provided for swipping. Match the embossed greeting card quantity at the entrance in the cardboard towards the final four (four) charge card numbers produced on the provider receipt. ) to watch, document and deal with card processes and safety. Every systems and techniques that “touch, ” control, or have the to have an impact on the visa or mastercard customer experience are inside compliance guidelines. impact and monetary ramifications of a breach include broken public opinion, forensic costs, fines from card companies, alternative of breached client credit cards, service charge of credit ranking monitoring for each customer to get a year, and annual statement of complying assessments with a qualified security assessor.

There are specific necessities associated with bank card orders, together with developing inside controls, that are complete in 404 Credit Card Vendor Services and PCI Conformity Policy. When part of State of arizona State University’s contracts with our bank and bank card corporations, to check out have the ability to accept cost business we’re needed to meet requirements developed by the Payment Card Industry Data Security Standard (PCI DSS) which is made to protect cardholder information. To further improve the effectivity and minimise the absolute quantity of price disputes, The Chargeback Business recommends putting into action Visa’s Supplier Purchase Query (VMPI). This is a function that aims to speed up challenge communication by providing retailers using a possibility to work alongside their mortgage lender or a qualified facilitator to provide additional know-how to Visa. Only 13% of stores surveyed was enrolled.

How Much is a Charge-back Fee?

Some supply a web-based addContent feature or a great SFTP option, some need responses end up being despatched through email, even so most banking institutions receive answers by way of fax. Before mailing your response, make sure that any kind of text or pictures happen to be darkish enough and can show up clearly in the fax transmission as any illegible textual content or knowledge might be considered incomplete. Give the service provider a adequate period of time to provoke a refund sooner than assuming scam is trustworthy.

Visa Chargeback Time Restrictions That Apply at the Acquirers and Sellers

It is dependant upon the chargeback reason code linked to the claim. But cardholders and merchants have different deadlines. Here’s what you need to know about the chargeback deadlines that involveMasterCard and Visa transactions. Now, the card networks is going to flow money from the services provider’s business checking account for the issuing bank. These networks provide the info connection to flow the funds via FedWire between cardholders and vendors.

Can I invert a charge-back?

Finance institutions Check to see Disputes upon Debit Cards. When using a credit card, in case of any kind of fraudulent operate, the user does not need to deal with the seller, thanks to the federal government Truth in Lending Action and the Fair Credit Billing Act.

Don’t allow anyone get your card, continue to keep personal info secure, and shop on HTTPS websites with a secure WIFI connection. We additionally strongly promoter that buyers sign up for products and services like Mastercard SecureCode and Approved by Australian visa. If the mortgage lender suspects youre filling bogus chargebacks as a method of cyber-shoplifting, the may select to shut your account. Your credit score rating are able to drop, rendering it tougher to get additional credit.

How much time does a chargeback dispute consider?

A reversal will come in when somebody attempts to recover money out of a impose that was made with a account. This varies from a dispute mainly because it is used in instances of unauthorized make use of. A chargeback happens when someone asks all their credit card/debit card service provider to return funds from a charge.

This is often reliable since the majority of merchants opt to keep away from charge-backs. If getting close the service provider does not work, you can use request a chargeback. Credit card chargebacks certainly are a common sort of client security that let you get your money back particularly conditions. Any time you request a chargeback, your own card supplier reviews the main points of your ask to evaluate if it’s a audio claim.

There are two main types of chargebacks – fraud (which includes the case and friendly fraud) and non-fraud. True fraud charge-backs happen when the acquisition had not been made by the cardholder, as with a case of identity robbery. Friendly fraudulence charge-backs occur if a cardholder disputes a charge that s/he have authorize boasting fraud and is also called “I didn’t get that” scam or cyber shoplifting. At this time there can also be non-fraud chargebacks, which might be purchases manufactured intentionally simply by cardholders then disputed under a say (e. g. they never received items, the products have been damaged, etc . ). Trying to find more help in chargeback disputes and the way to manage chargebacks normally?

Customers are much less vulnerable to initiate a chargeback in cases when they definitely feel they can rapidly and easily eliminate their considerations through a company’s customer support department. Proactive and efficient customer care is often skipped as a route to both forestall and efficiently represent charge-backs. Merchants should to clearly display customer service speak to data on their website and on their very own checkout web site, alongside crystal clear discount insurance policies. Chargebacks are a expensive, expensive and aggressive drawback. First, they arrive in all sizes and shapes and impact all kinds of merchants.

Time Limit Modifiers

- Managing charge-backs is demanding under one of the best of instances, and while chargeback cut-off dates certainly present a profit, they’ll associated with method far more stressful with regards to retailers.

- By assessing a business’s coverage, we can determine and remove potential chargeback triggers so sellers keep away from chargebacks and linked charges.

- It can be additionally it despatched by physical mail.

- Each service provider manages to lose a charge-back, the argue is shut and so they cannot petition further.

The acquirer receives the merchant’s compelling evidence in the merchant account processor. Might move this alongside for the cardboard community, which might be despatched that to the issuer.

The Repayment Card Industry Data Reliability Standard (PCI DSS) can be described as set of reliability requirements designed to be sure that all firms that be happy with, course of, shop or transmit bank card facts preserve a secure setting up. For merchants who have dropped their chargeback dispute during any of the three cycles, or decided not to competition the charge-back, they’re your money from your sale, the merchandise sold, plus any charges incurred. When a service provider manages to lose a chargeback, the argument is sealed and they can’t petition any additional. When the giving bank notifies the ordering bank in the second chargeback, and that info is presented with to the company, the service provider is once again given a chance to simply allow or tournament.

Can my own bank reverse a payment?

While most customers exactly who use PayPal to create a purchase with you will procedure their grievance through a PayPal dispute or claim, some might go to all their credit card company to file a chargeback. Additionally , if a visa card is used in a fraudulent purchase, the cardholder may also ask for a chargeback.

These types of timeframes vary depending on the cardboard program, i. electronic. Visa or perhaps Master card.

Seldom do card providing banks realize some https://www.chargebackgurus.com/blog/dont-run-out-the-clock-understanding-chargeback-time-limits of these things for the purpose of the scams it really is. The purchaser is definitely hoping that corporate that sold the T. Sixth is v.

For example , claim a business causes it to become inconceivable to request a conventional repayment by not really displaying get in touch with info or failing to acknowledge your requests. This could be a deliberate transfer for the area of the service provider, or it might just be dangerous customer support.

This kind of chargeback occurs when the supplier sells a product at the next value to the distributor than the price they also have set with the end person. The supplier then submits a charge-back to the provider to allow them to recuperate the cash dropped in the transaction.

No matter where you are within the chargeback method, you’ll need to have compelling data if you want to battle the dispute. Having the data saved to a folder inside your laptop or inside a repository that’s easily accessible can help stop a lot of frustration. Specifically if the process prospects you to an arbitration, you will be happy to have your evidence useful. The chargeback process may final from a single month to six months.